You have taken a home loan and it may take a significant amount of your take-home-salary to pay for it’s EMI.

Usual tenures for home loan are 20 years , 25 years and 30 years but the most common is 20 years.

There are times in life when you are looking at monthly bank statements and want to get rid of home loan EMI at the earliest.

Scenario – Let’s consider a scenario where you have taken a home loan for 20 years and half way through it’s tenure, you think that you are in a position to repay the remaining amount.

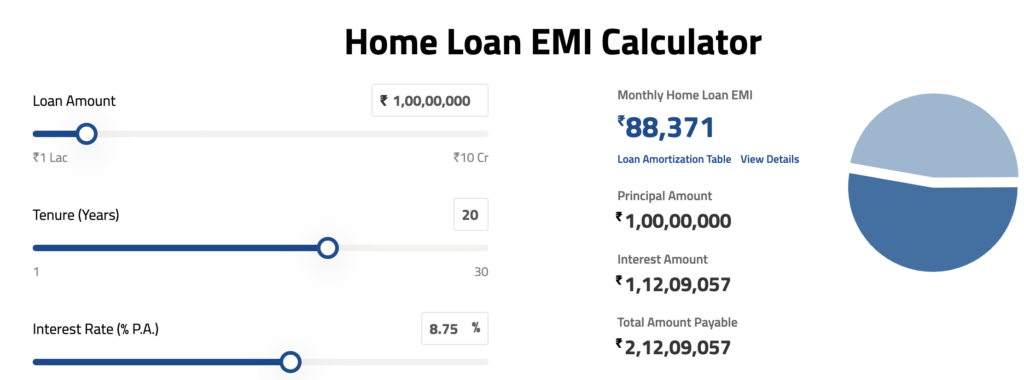

High Level Loan Details

| Loan Amount | 1 CR |

| Loan Tenure | 20 years |

| Loan EMI | 88,371 |

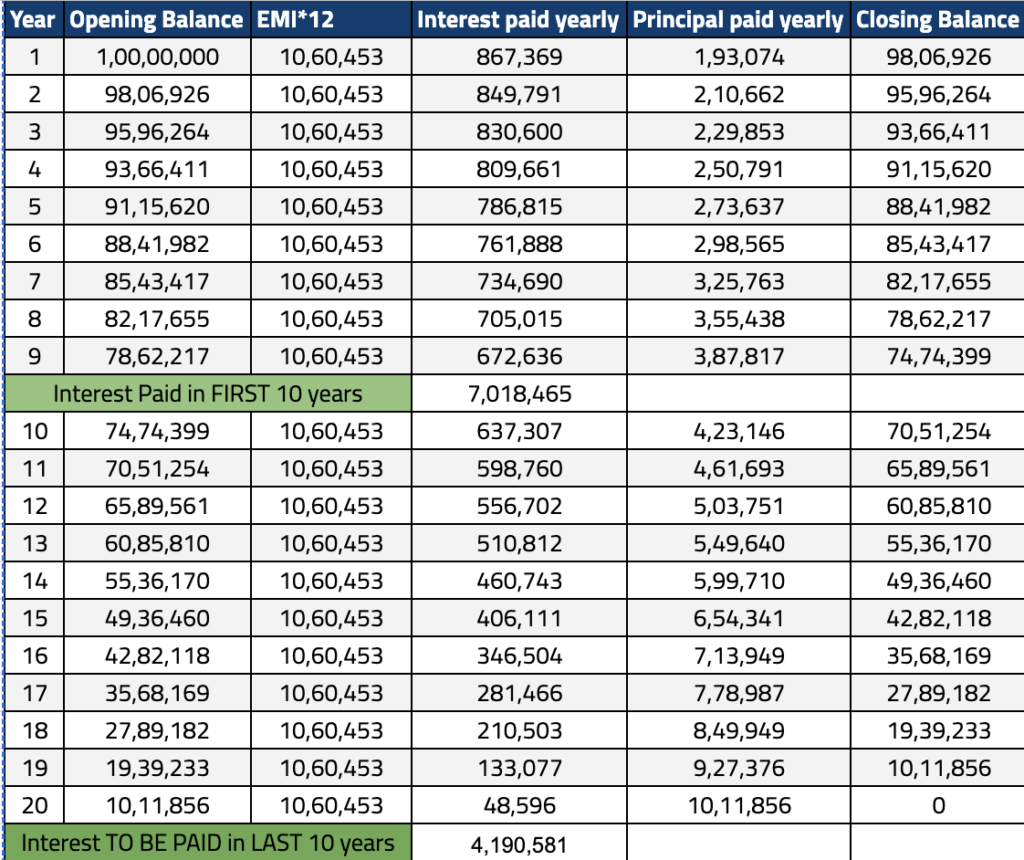

Amortization Schedule

Interest paid in the FIRST 10 years

From the above amortization schedule, you can see that although 50% of the loan tenure is over but principal repayment is only 30%.

Please note that in the initial years, most of the EMI goes towards interest payment.

Intrest paid in the first 10 years in 70 lacs.

Interest to be paid for last 10 years

Interest paid in the last 10 years is APPX 42 lacs.

Scenario

Let’s look at the original scenario again –

- You have paid EMI’s for 10 years

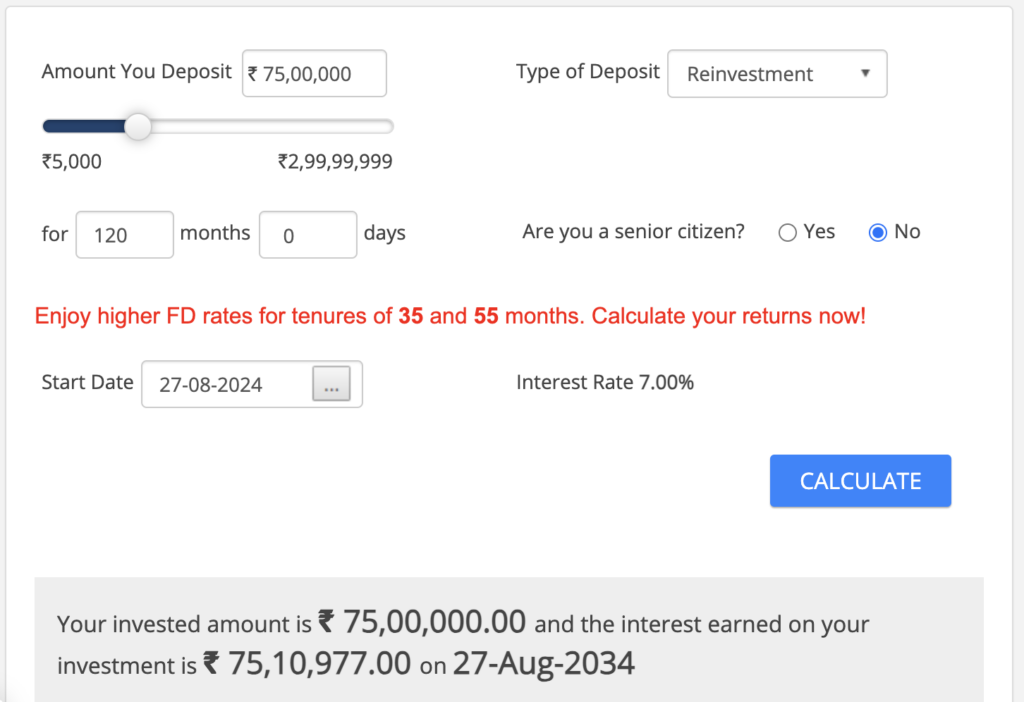

- You have 75 lacs cash and want to repay the home loan fully

Assumptions

For the sake of simplicity, I am making the following assumptions

- Since you have sufficient cash to repay the remaining home loan of 75 lac, I am assuming that you can still pay home loan EMI for the next 10 years

- Home loan rate remains at 8.75% through the 20 years and FD rate remains same at 7% for next 10 years

Consider booking a FD?

Final Word

Before making a decision to repay home loan, consider safe investment option only which give guaranteed returns.

Do not be tempted by mutual funds or other capital market instruments lime stocks , futures and options.

I have used HDFC Home Loan calculator and FD calculator. You can play around with the numbers based on your current situation.